Trading 212 Platform Review 2024: Trading 212 is an online brokerage platform that allows users to trade stocks, ETFs, forex, and CFDs. Founded in 2011, Trading212 aims to provide an easy-to-use and low-cost trading platform for self-directed investors.

Key Details About Trading212

| Detail | Description |

|---|---|

| Year Founded | 2011 |

| Headquarters | London, UK |

| Regions Served | Europe |

| Trading Platforms | Web, Mobile Apps |

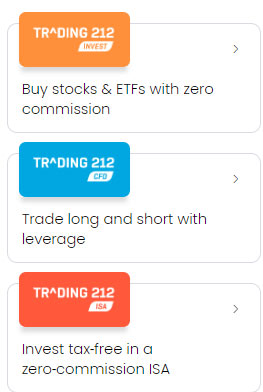

| Asset Classes | Stocks, ETFs, Forex, CFDs, Cryptocurrencies |

| Account Minimum | $0 |

| Trade Commissions | $0 for stocks and ETFs |

What is Trading 212?

Trading 212 is an online brokerage platform designed to make investing accessible for everyone. The company was founded in 2011 and is based in London, UK with services focused on the European market.

Some key things to know about Trading 212:

- Offers commission-free trading on over 3,000 stocks and ETFs

- Also provides access to forex, CFDs, and cryptocurrency trading

- User-friendly mobile and web trading platforms

- Requires no minimum deposit to open an account

- Backed by thousands of positive customer reviews

Overall, Trading 212 aims to open up investing to those new to the stock market by providing an easy-to-use yet powerful platform with zero commissions.

Trading212 Platform Review

The Trading212 web and mobile platforms offer a user-friendly yet full-featured trading experience. Key aspects of the Trading212 platform include:

Simplicity – The platform uses a clean, intuitive design making it easy for beginner investors to buy and sell assets. At the same time, more advanced charting and screening tools are available.

Customizability – Users can tailor the platform to their preferences, with support for light and dark modes, different languages, and adjustable layouts.

Tools – Research tools like screening, charting, risk management analytics, and virtual trading help investors make decisions. Built-in social features allow sharing strategies.

Asset Classes – Trading212 supports trading of stocks, ETFs, forex, CFDs, and cryptocurrencies all from a single account. Fractional share trading is also available.

Costs – There are zero commissions on stock and ETF trades. Other fees are competitive compared to other online brokers. Margin trading fees also apply for leveraged positions.

Overall, Trading212 aims to combine an intuitive interface with pro-level functionality – an appealing option for self-directed investors.

Trading 212 Stocks Review

For stock and ETF investing, Trading212 offers a compelling commission-free solution. Highlights include:

Commission-Free Trading – There are zero commissions to buy or sell stocks or ETFs, unlike most brokers that charge $5-$10 per trade. This makes frequent trading very affordable.

** Fractional Shares** – Investors can purchase fractions of shares (e.g. $50 of Amazon stock) giving more flexibility, especially for high-priced stocks.

Worldwide Markets – Access to major stock exchanges globally including the NYSE, NASDAQ, and London Stock Exchange covering over 3,000 assets.

Intuitive Platform – Easy-to-use buy/sell tickers, customizable layouts, and available technical indicators make executing stock and ETF strategies seamless.

Limited Research – While Trading212 gives access to news and basic charts/screening, there is less research compared to full-service brokers. Most suitable for self-directed stock picking.

For DIY stock investors seeking an affordable, user-friendly platform, Trading212 delivers nicely. The fractional share and commission-free trading support more flexibility in investing.

How to Buy Shares on Trading212?

Buying shares on Trading212 takes just a few simple steps:

- Open Account – Sign up for a Trading212 account online or via mobile apps. No minimum funding is required.

- Deposit Funds – Fund your account via bank transfer or electronic wallet. Money deposits are free of charge.

- Find Assets – Use the search bar, screening tools, or browse to find desired stocks or ETFs. Over 3,000 available.

- Analyze and Decide – View charts, related news, and data on potential investments. Use analytics like price targets before deciding.

- Make Order – Enter share amount, set order type (market, limit, stop loss), and preview commission charges (zero for stocks).

- Execute Trade – Place buy order during trading hours. Fractional shares supported.

- Manage Positions – View your portfolio and manage orders all from the intuitive Trading212 dashboard.

With commission-free trades and fractional share capability, Trading212 removes barriers for investing in stocks affordably.

Trading212 Trading Platform Login

To access your Trading212 account, simply follow these steps to log in:

- Go to www.trading212.com homepage

- Click on the Log In button in the top right corner

- Enter your email address used when registering your account

- Input your account password

- Click the Login button to access your Trading212 dashboard

- Alternatively, download the Trading212 mobile apps for iOS or Android and log in with your credentials there.

Once logged in, you’ll see your Trading212 dashboard with account details, watchlists, charts, order status and more. Enable two-factor authentication for enhanced account security beyond password login. Reach customer support if login issues occur.

Trading212 Trading Fees

As an online brokerage, Trading212 generates revenue through various trading fees and account charges. Key Trading212 fees include:

Stock/ETF Trades – $0 commission per trade; fractional shares supported

Forex Trades – Typical spread markup; averages ~0.9 pips on EUR/USD pair

CFDs – Small overnight and spread fees; details per asset

Deposits/Withdrawals – Free deposits; £2/$3 wire withdrawal fee

Inactivity Fees – None

Maintenance Fees – None

Margin Trading – Applicable interest charged daily

While Trading212 is commission-free for stock and ETF investing, other instruments like forex and CFDs do incur trading costs. Active trading can trigger higher fees so check pricing tables before placing trades. All trading fees are displayed on the Trading212 website.

How to Withdraw Money From a Trading212 Brokerage Account?

Follow these key steps to withdraw your money from a Trading212 investing account:

- Log into your Trading212 dashboard

- Click on the funds management icon to view your account balance

- Select Withdraw Funds and choose the amount you wish to take out

- Pick your withdrawal method – bank transfer or electronic wallet

- Double-check account and recipient details to avoid errors

- Submit the withdrawal request and allow approximately 1-3 days for processing

- A £2/$3 fee generally applies for bank wire transfers

Be sure to leave a sufficient account balance if you have any pending buy orders or margin requirements on positions. Reach out to Trading212 customer service with any withdrawal issues.

How to Add Money to a Trading212 Brokerage Account

Adding money to your Trading212 account can be done in two ways:

Bank Transfer

- Log into the account, select deposit funds, and choose bank transfer method

- Send money from your bank account to Trading212 using the account details provided

- Transfers generally complete within 1 business day

Electronic Wallets

- Trading212 supports Skrill and Neteller digital wallet services

- Log into e-wallet account and select withdraw to Trading212 option

- Enter your Trading212 account details when prompted

- Transfers typically complete within hours

Deposits via bank transfer or digital wallets are free. Ensure you have verified your Trading212 account before moving money. Funds must settle before trading.

How to Buy and Sell Stock on a Trading212 Brokerage Account?

Buying Stock

- Search stock ticker or find from the watchlist

- Enter the number of shares (fractional supported)

- Set order type – market, limit, stop-loss

- Review order and preview commission (zero)

- Complete order during market hours

Selling Stock

- Navigate to portfolio holdings

- Select stock position

- Enter the number of shares to sell

- Set order type

- Review the order and confirm

- Complete sale during market hours

Repeat for other stocks or ETFs you want to trade. Use price alerts and market data to optimize order timing.

How to Open a Trading212 Brokerage Account

Opening a new Trading 212 brokerage account takes just minutes thanks to their intuitive digital account opening process:

- Go to the official website www.trading212.com

- Click the “Open an Account” button

- Select your country (United Kingdom) then click ‘Next’,

- Select your account type for trading

- Enter your email address

- Create account password

- Confirm you accept Trading 212’s Terms and Conditions

- Click the ‘Create Account’ button.

- Verify email address via confirmation link

- Receive a welcome email with the account activated.

With no paperwork, no minimum balances, and no hidden fees, Trading 212 removes all barriers to investing for any experience level. Customizable platform settings allow fine-tuning control and learning resources help newer traders enormously as well.

Contact & Support of Trading 212

Address:

Trading 212 UK Ltd.

Aldermary House, 10-15 Queen Street,

London, EC4N 1TX.

For more details related to Fees, Promotions, CFD, Invest & ISA, Manage Fund, Open Account, Pies & AutoInvest, etc., access the Help & Support page at https://helpcentre.trading212.com/hc/en-us